AvaTrade values its clients and has put measures to ensure you have an enjoyable and rewarding trading experience.

- Unique Mac Trading platforms tailored for mac users

- Highly rated AvaTradeGo app on Google Play and the App Store

- Plenty of cryptocurrencies to trade 24/7

- Experts advisors on the MT4 and MT5 platforms

- Massive selection of learning materials

- Seamless and quick deposits and withdrawals

- Minimum deposit of £2,000 to access DupliTrade’s portfolio

- Minimum deposit of £500 to access ZuluTrade copy trading platform

- AvaProtect is only available on forex, silver, and gold trades

- Limited range of financial assets

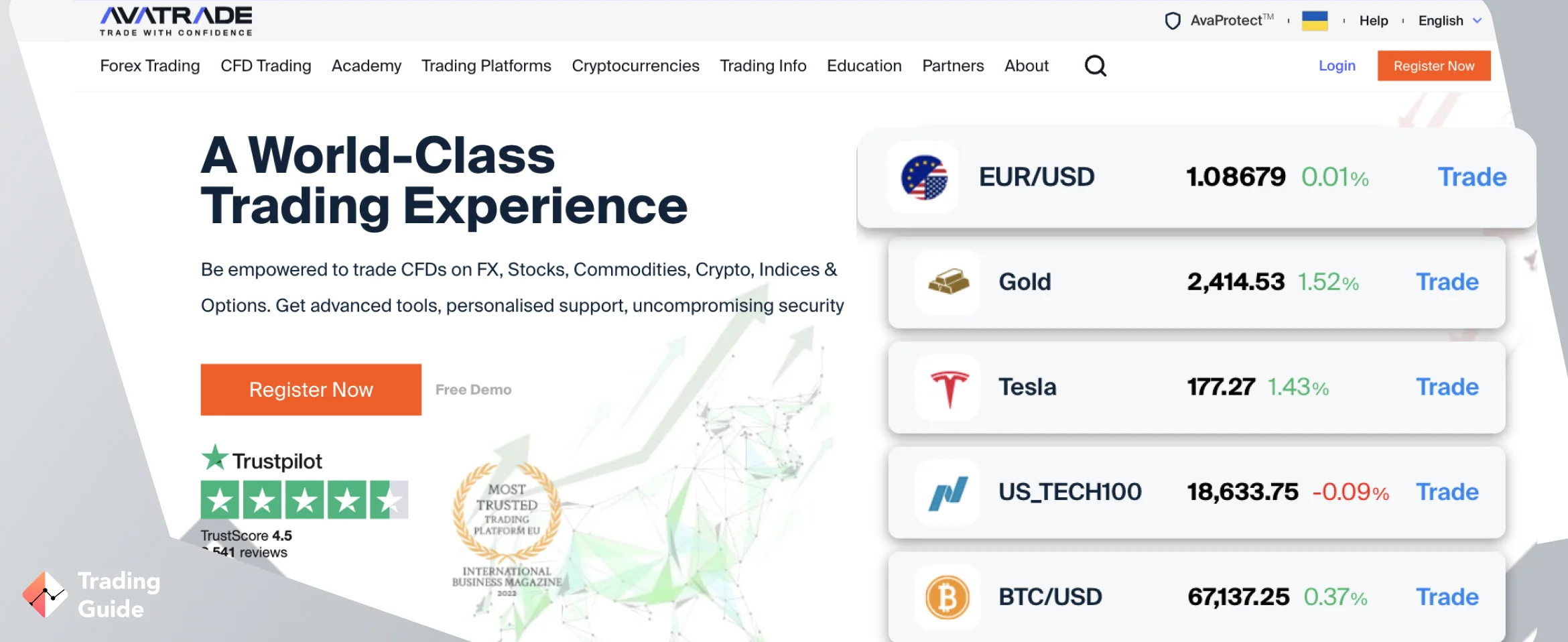

Embarking on its journey in 2006 as a prominent forex broker, AvaTrade has forged an impressive legacy, fostering enduring connections with over 400,000 clients to date. Its unwavering commitment to stringent regulation instils unparalleled confidence and trust among investors and traders alike. Our comprehensive review delves deep into AvaTrade’s offerings, dissecting its services, reliability, and user experience. Join us as we navigate this established platform, uncovering its strengths and intricacies to empower your trading journey.

Our Opinion About AvaTrade

Our experience with AvaTrade was remarkably smooth, characterised by seamless activities across the platform. One standout feature was the low minimum deposit requirement, zero commissions on trades, and consistently low spreads, providing an advantageous edge for traders. The provision of abundant learning resources, coupled with social and copy trading platforms, as well as a demo account, catered comprehensively to both beginners and seasoned traders.

AvaTrade’s strength lies in its diverse asset selection and multiple platforms, including the popular MT4 and MT5, accommodating various trading styles. In addition, we noticed the AvaProtect feature on the broker, even though it only supports forex, silver and gold trading. We hope that the risk-limiting tool will soon feature on all assets, thereby allowing all traders to benefit.

The support for automated trading on platforms like AvaSocial and DupliTrade enhances convenience for users seeking computerised strategies. Notably, the AvaTradeGO trading app has earned high praise across Google Play, the App Store, and Trustpilot, showcasing its user-friendly design and functionality.

However, limitations exist, such as the inability to purchase and take full ownership of featured assets. Its customer support also operates five days a week, which may inconvenience active traders who open positions on a daily basis. Despite this, the support team’s responsiveness and ability to provide relevant solutions diminish the impact of this drawback.

From our comprehensive experience, we highly recommend AvaTrade to active traders seeking short-term positions. Additionally, it is an excellent option for newcomers and MetaTrader enthusiasts, offering a diverse range of features and resources tailored to various trading preferences.

What We Like

- Seamless Trading Experience: Our experience with AvaTrade was marked by seamless transactions and operations throughout the platform.

- Low Minimum Deposit and Zero Commissions: The low minimum deposit requirement of £100 and the absence of commissions on trades offer a cost-effective trading environment.

- Abundant Learning Resources: AvaTrade provides an array of educational materials catering to both novice and experienced traders. The availability of social and copy trading platforms, along with a virtual demo account, enhances the learning curve.

- AvaTradeGO Trading App: The AvaTradeGO mobile app received high praise across multiple platforms for its user-friendly interface and functionality, offering traders flexibility and convenience on the go.

What We Don’t

- Limited Support Operating Hours: The customer support service operates only five days a week, potentially causing inconvenience for traders seeking assistance outside these hours. However, the responsiveness of the support team mitigates this drawback to some extent.

- No Direct Asset Ownership: Traders do not directly own the assets they trade on AvaTrade. Instead, they speculate on price movements, which may not align with the preferences of some investors.

AvaTrade In-Depth

Our exploration of AvaTrade, based on extensive testing and hands-on experience, unveils a comprehensive view of this trading platform. Unlike many other brokers, AvaTrade offers a seamless trading experience with a low minimum deposit requirement and zero commissions, fostering an environment conducive to traders of varying budgets. See the table below highlighting the key features of this broker for better understanding.

| Features | Availability |

|---|---|

| Minimum Deposit Requirement | £100 |

| Regulatory Licences | FCA, CySEC, ASIC, FSCA |

| Demo Account | Yes |

| Advanced Platforms | MT4, MT5, AvaSocial, DupliTrade, etc. |

| Trading Instruments | Stocks, Forex, Cryptos, Commodities, Crypto |

| Support Service | Email, Live Chat, Phone |

| Mobile App | Google Play & App Store |

| Cost per Trade | Low spreads, zero commissions |

Security

In our exploration of AvaTrade, we conducted an in-depth analysis of the platform’s security measures. Our findings revealed that AvaTrade places a paramount emphasis on user security. We discovered that the platform implements industry-standard encryption protocols, ensuring the safe transmission of our sensitive data across devices and AvaTrade’s servers.

Moreover, our thorough investigation confirmed that AvaTrade strictly adheres to regulatory standards set by the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Central Bank of Ireland (CBI)* and more, further solidifying our trust in the platform’s commitment to security. These measures are in place to safeguard against potential risks such as fraud or unauthorised access to user accounts.

Based on our user-centric evaluation, we confidently give AvaTrade a 5-star rating for its robust security infrastructure and unwavering dedication to ensuring the safety and protection of its users’ data and assets.

Note: AvaTrade CBI regulation in Europe only applies to members of the European Union. This also means that some countries in the EU have other financial authorities regulating their activities.

Platform and Account Types

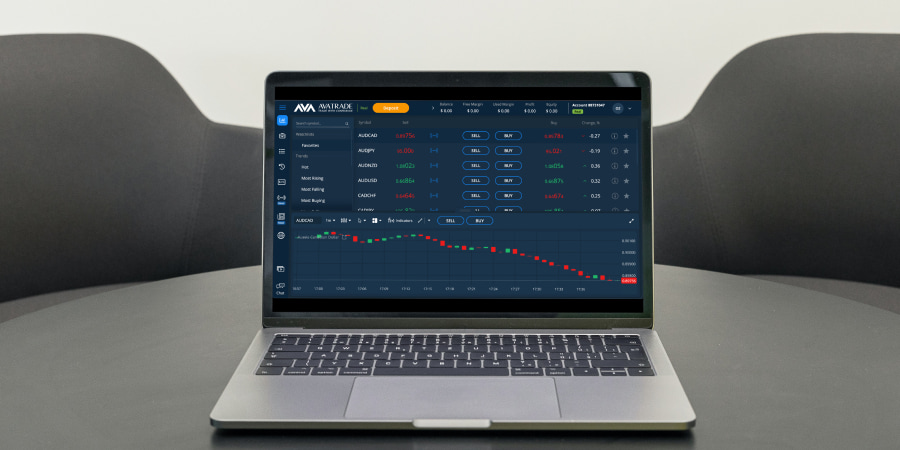

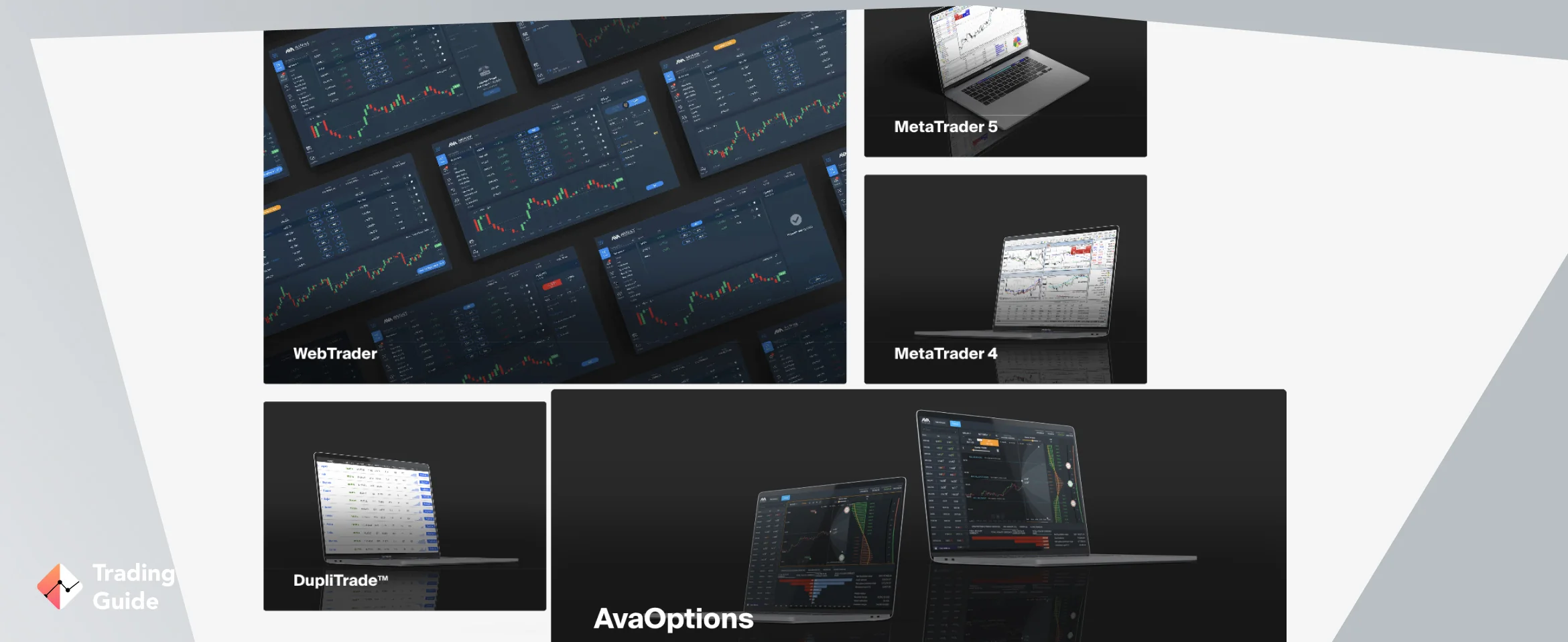

In our exploration of AvaTrade’s platform, we discovered a diverse range catering to various trading preferences. The available platforms include WebTrader, AvaOptions, MT4, MT5, and automated trading options, each offering unique functionalities and user-friendly interfaces.

AvaTrade’s platforms provide real-time market data, customisable watchlists, and intuitive charts, empowering users to make informed decisions confidently. Additionally, we found the trade execution speed to be fast, ideal for managing short-term positions efficiently.

Regarding account types, AvaTrade offers a demo account with £100,000 virtual funds for testing it and gauging your skill level. Muslims get to trade using the swap-free Islamic account, and there is also a retail or standard account for all retail traders. Other featured accounts include a corporate account for businesses, a professional trading account with higher leverage, an options account for forex options trading, and a spread betting account for UK and Ireland traders. Overall, we rate AvaTrade’s platform and account types at 4.2 stars, recognising its strengths while acknowledging opportunities for further enhancement.

| Type | Fee |

|---|---|

| Inactivity Fee | USD Account: $50 EUR Account: €50 GBP Account: £50 |

| Administration Fee | USD Account: $100 EUR Account: €100 GBP Account: £100 |

Fees

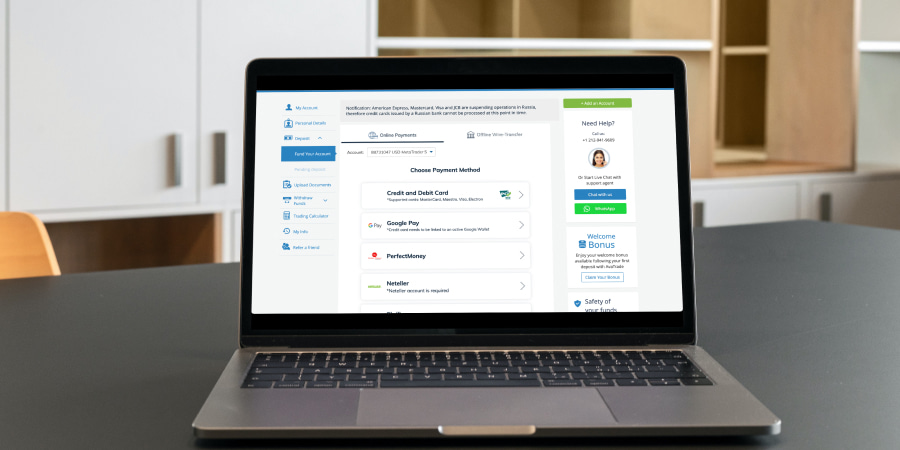

In our thorough investigation of AvaTrade’s fee structure, we discovered a balance of competitive pricing and transparent policies catering to traders’ needs. The broker impresses with a modest £100 minimum deposit requirement, ensuring accessibility for traders of varying budgets. All deposits and withdrawals are also free, thus eliminating additional costs associated with fund transfers. And when it comes to copy trading on DupliTrade and ZuluTrade platforms, you will be required to deposit at least £2,000 and £200, respectively, to gain access.

However, it’s essential to note that AvaTrade charges an inactivity fee of £50 after 3 months. Moreover, traders should be mindful of the administration fee amounting to £100, which may apply under certain circumstances. For overnight positions, AvaTrade applies Overnight Premium fees, a standard practice within the industry. Its spreads are also among the lowest, starting from 0.9 pips on major currency pairs. From our assessment, AvaTrade deserves a 4.7-star rating in this category.

| Type | Fee |

|---|---|

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £50 quarterly |

| Overnight Charges | From 2.3% |

| Margin Rate | From 10% |

Mobile Compatibility

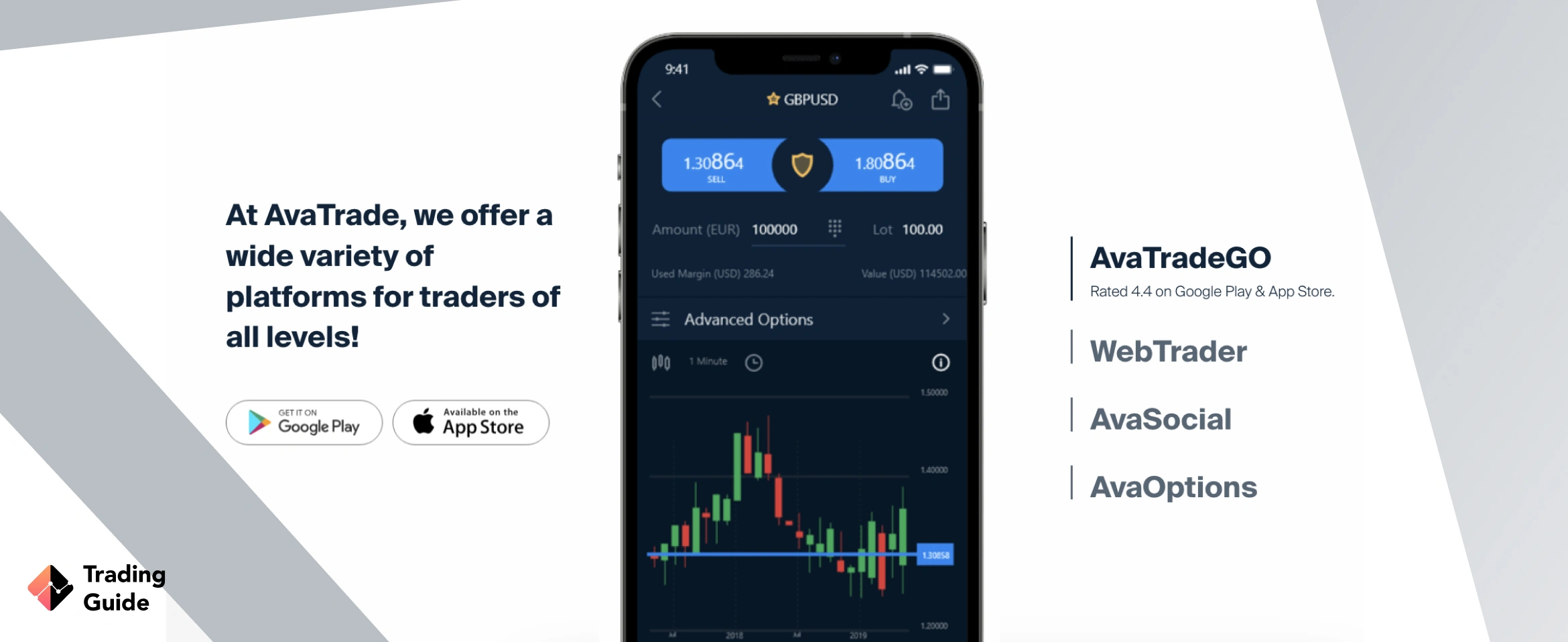

In our exploration of AvaTrade’s mobile compatibility, we were impressed by the platform’s exceptional accessibility and functionality on mobile devices. The AvaTradeGO mobile app, available on both Google Play and the App Store, stood out as a highlight. Its intuitive design and seamless user experience make trading on the go a hassle-free endeavour. Plus, AvaTrade’s interface ensures easy navigation and offers a comprehensive suite of tools, thus enabling traders to execute trades, access market analysis, and manage their portfolios efficiently.

We also noticed that the AvaTradeGO app continues to receive widespread praise from users across platforms like Google Play, Trustpilot, and the App Store, reflecting its high user satisfaction and reliability. The best element about it is that it allows users to access all features on the web platform, including the MT4 and MT5 platforms, ensuring seamless activities.

Considering the robust functionality, user-friendly interface, and positive feedback from users, we confidently award AvaTrade’s mobile compatibility a 5-star rating.

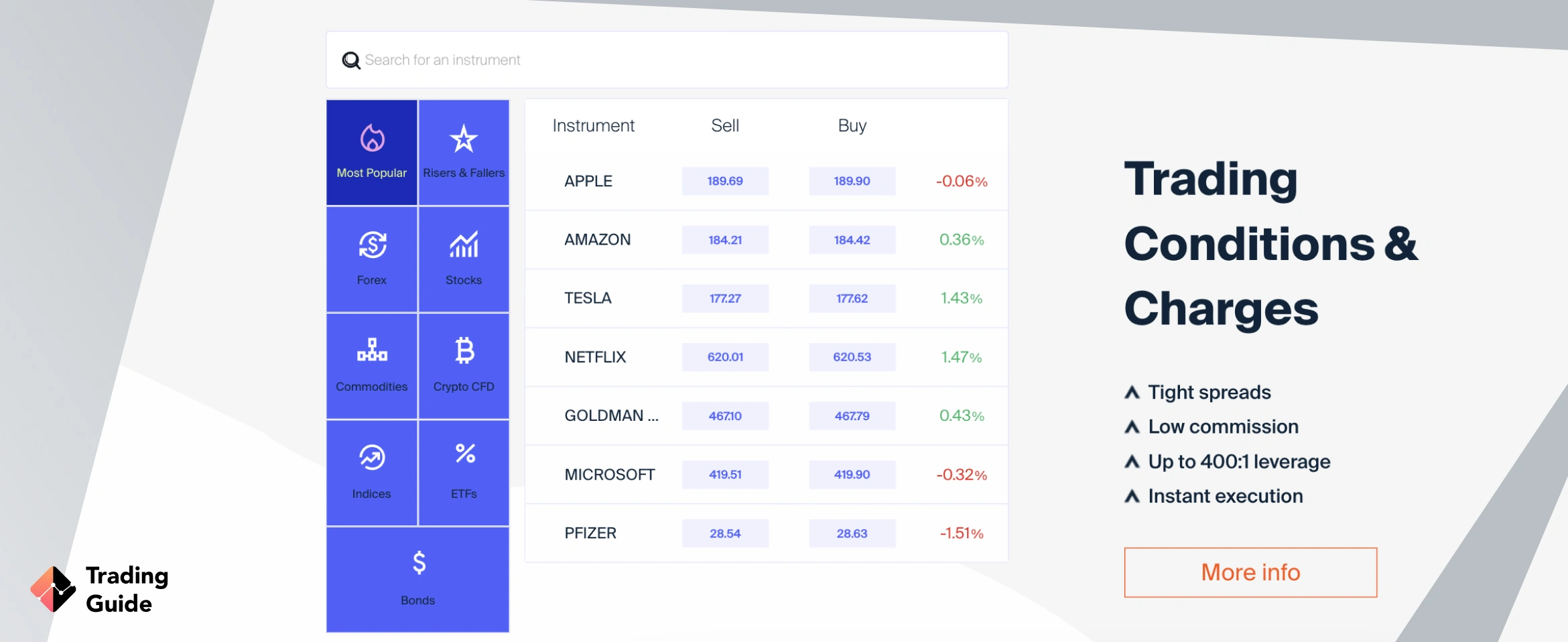

Product Offerings

AvaTrade impresses with a robust portfolio of over 1250 assets, encompassing a wide range of trading instruments. The platform caters to diverse investment strategies, providing access to various markets through Forex and CFDs. Let’s take a look below at the featured assets on this broker’s platform.

- Forex – AvaTrade facilitates trading in a broad spectrum of currency pairs, enabling exposure to the dynamic forex market and diverse CFD options.

- Stocks and Commodities – The platform offers a comprehensive selection of stocks and commodities, allowing users to invest in companies and raw materials across global markets.

- Cryptocurrencies – AvaTrade supports trading in cryptocurrencies, providing access to a multitude of digital assets, including popular ones like Bitcoin, Ethereum, and more.

- ETFs, Bonds, Treasuries, and Indices – AvaTrade’s offerings extend to ETFs, bonds, treasuries, and indices, offering diversification opportunities and exposure to various sectors and industries.

Unfortunately, AvaTrade doesn’t support buying and taking full ownership of physical assets. You can only trade them as CFDs. We also noticed that the broker doesn’t host mutual funds and futures, leading us to award it a 4.4-star rating in this section.

Education Tools

Exploring AvaTrade’s educational centre, we found an impressive array of resources catering to traders of all levels. From foundational guides to advanced strategies, AvaTrade’s education hub covers a spectrum of topics crucial for informed trading decisions. Its commitment to comprehensive learning materials empowers beginners and professionals alike to navigate the markets confidently. With an extensive range comparable to leading platforms, AvaTrade’s Education Tools earn a solid 4.7-star rating for its depth and accessibility.

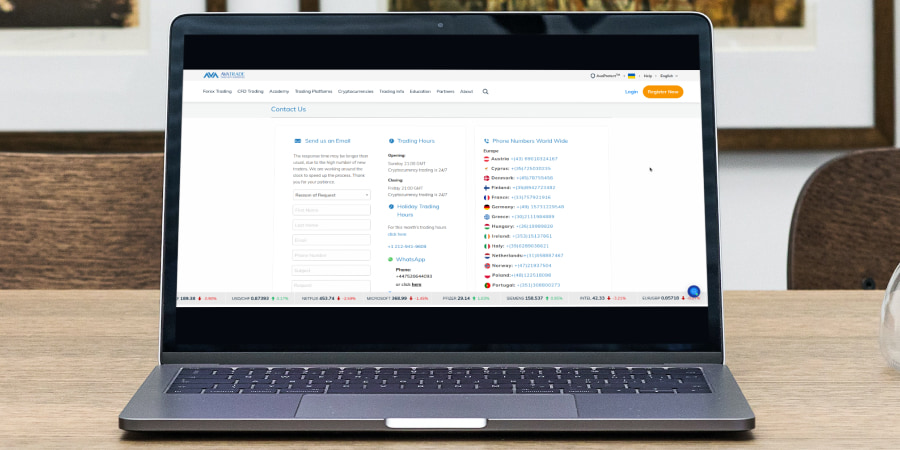

Customer Service

Engaging with AvaTrade’s support service was a seamless experience. Its multi-channel approach ensured prompt responses and relevant solutions to our inquiries. We found the broker’s support team to be highly responsive, addressing our queries efficiently via various channels. This positive experience echoes the sentiments of numerous satisfied users who have praised AvaTrade’s customer service. Given its prompt and effective assistance, we rate AvaTrade’s Customer Service with a 4.8 stars for its exceptional support and dedication to user satisfaction.

How to Sign Up For an Account at AvaTrade

AvaTrade has different trading accounts to choose from depending on your experience level and requirements. Based on our experience, the procedures for signing up are straightforward, leading us to award the broker with a 4.5-star rating. Let’s take you through these simple steps below.

The first step is to visit AvaTrade’s website by clicking on any links we have shared on this page. If you are a beginner, ensure you read and understand the broker’s terms and conditions. Plus, install its mobile trading app to easily manage your positions anytime you step away from your trading station.

Once you have completed step 1 above, click the “Register Now” button and enter your personal details, including name, date of birth, email, phone number, employment information, etc. Alternatively, you can sign up using your Google or Facebook account. AvaTrade will also require you to create a username and strong password for an added layer of security.

As part of regulatory compliance, AvaTrade may require identity verification. This may include submitting copies of your original government-issued ID card, passport or driver’s licence. AvaTrade also requires its users to verify their location by submitting copies of recent utility bills or bank statements. The verification process may take up to 48 hours, after which you will receive an email notification.

Once your account is fully activated, proceed to fund your trading account using available deposit methods specifically offered to UK traders. Note that AvaTrade’s minimum deposit requirement is £100, and you can make deposits using credit/debit cards, e-wallets, or bank transfers.

With your account funded, you’re ready to begin trading. Log in to your AvaTrade account and explore the range of instruments available for trading, including forex, stocks, commodities, cryptocurrencies, and more. For beginners, start by exploring AvaTrade’s demo account before investing real money. Most importantly, apply risk management controls, such as take-profit and stop-loss orders, to mitigate losses if they occur.

Alternative to AvaTrade

For traders seeking alternatives to AvaTrade, several reputable brokers offer diverse features and trading opportunities. Here are some noteworthy alternatives to consider:

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| eToro* | $100 | Yes | Yes | Yes |

| Plus500* 80% of retail investor accounts lose money when trading CFDs with this provider. | £100 | Yes | Yes | Spread Only |

| XTB | £0 | Yes | Yes | Yes |

| Spreadex | £0 | Yes | Yes | Yes |

Disclaimer: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Is AvaTrade Good For You?

Choosing a trading platform like AvaTrade depends on several factors aligned with your trading goals, preferences, and experience level. For beginners stepping into trading, AvaTrade’s accessible interface and comprehensive educational resources make it an enticing choice. The platform’s diverse account types cater to varying experience levels, providing a smooth entry into the trading world.

Intermediate traders find AvaTrade appealing due to its wide range of trading instruments and advanced analytical tools. The platform’s commitment to aiding skill advancement through educational materials and responsive customer service adds value to traders refining their strategies.

Professional traders benefit from AvaTrade’s array of advanced features, including automated trading options and a diverse asset selection. Its multiple account options and competitive pricing structure cater to the needs of seasoned traders, enhancing their trading experience.

In summary, AvaTrade’s accommodating interface, diverse asset selection, and educational resources suit traders across various proficiency levels. However, ensuring alignment with your specific trading goals and preferences is crucial before choosing AvaTrade as your preferred trading platform.

FAQs

Yes. AvaTrade has existed for over 15 years and remains popular among traders globally because of its impeccable services and tools. In addition, the broker is regulated by multiple authorities like the ones listed in this guide above, indicating that your funds and data will be secured.

Among the authorities that have licensed AvaTrade, we find the Central Bank of Ireland, the Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC), just to mention a few.

In other words, there is no reason to not trust Avatrade with your personal information, money, and trading efforts.

Absolutely, but there are never any guarantees since trading always carries certain risks. Over the years, we have witnessed many traders earn profits trading various assets hosted by AvaTrade. Although the broker does not guarantee profits, you need to fully understand the assets you want to trade and conduct a thorough market analysis to maximise your potential.

Keep in mind that up to 80% of all retail traders lose money in the long run. To beat these statistics you have to prepare yourself with knowledge about the instruments you’re trading, and experience trading them.

No. AvaTrade is a forex, cryptocurrency and CFD broker. Stock trading is only allowed as CFDs, meaning that instead of buying and taking ownership of stocks, you will only speculate on their price movements and profit from the difference. The good news is that AvaTrade allows you to explore some of the world’s top companies, including Apple, Tesla, Tesco, Barclays, Adidas, etc.

Yes. AvaTrade allows PayPal as a payment method in some countries, including the UK. However, if you cannot access PayPal in your country, consider other payment methods such as Neteller, Skrill, Qiwi, and more.

Before registering an account with Avatrade – or any other online broker – you need to ensure that it offers payment options that you are comfortable with. Keep in mind that you will not only deposit funds to the broker but also (hopefully) withdraw profits. Because of this, you need to pick a broker with payment options that you can use freely. Otherwise, you run the risk of locking your profits to an account which you cannot withdraw funds from.

AvaTrade is located in Dublin, Ireland and extends its trading services to clients across various regions globally. So whether you are a novice or expert trader, the broker strives to make you have a worthwhile experience through its adaptable platforms.

Since AvaTrade is a global broker that offers services in all of Europe, Australia, and parts of Africa and Asia, they also have smaller local offices around the globe. In addition, their customer service has numbers for each specific country where it operates and you can, in most cases, talk to a representative that speaks your native language. This is a great service that not all brokers provide and that we really appreciate AvaTrade for.

No. Unfortunately, the FCA does not regulate AvaTrade. The good news is that it is regulated by the Financial Services Commission (FSC), which is the regulatory body of the British Virgin Islands, thus accepting UK clients.

I think AvaTrade is more secure than other brokers because AvaTrade has a lot of oversight, the main MT 4,5 software has all this information. I think is a great broker!!

Are Avatrade alternative brokers profitable?

YES! I successfully trade with them already for three months 🙂 🙂 🙂

The account is easy to open and the customer service people are ready to help 24/7

I used to trade with AvaTrade for about a year. Currently, I don’t have a funded account here as I had to withdraw all my deposits due to my personal issues. Yet, this was a decent brokerage with a long-term corporate history, good reputation, and affordable trading fees. The first thing to notice is that they are regulated and registered under FCA, which is important for me!

One of the most practical tips is to start with smaller amounts of money and slowly increase your position size. Do not invest large sums if you are a beginner in online trading. Also, avoid sweating too often. It is better to trade a little bit with gains than to scalp all day without knowing why you are entering the market and losing your stake. Make the right investment choices that will help you earn money in the long run.

I really like this broker. AvaTrade also offers social trading, which allows you to follow the trading activity, engage in discussion, and even copy the trades of other traders.

When looking for a trading broker, you should start from the following:

How much money do you want to deposit?

What kind of instruments do you want to trade?

How often do you want to trade?

AvaTrade is a great broker following these questions!

They are just a broker platform just like many others, Etoro, IG, etc. They provide broker services for trading forex, CFDs and stocks. You can check with their websites for detailed information. I haven’t used their services much. I use Etrade and Fxview because the transaction costs are very low and the spreads are tight. I don’t face any issues with placing an order and the MT5 runs smoothly. You can also try opening a demo account with any broker of your choice to get a better view of how things work at their platforms.

AvaTrade for me is a genuine broker. First they offer $20 bonus and trust me this is the best in the industry since they have a very few conditions to meet for profit withdrawals. second, They don’t charge any % for all deposits and withdrawals and moreover the withdrawal are very fast as compared to other brokers. They have a very huge options for Forex trading. Overall, I have used AvaTrade for 3 years now and I am a very happy client. I also use Forex.com and HotForex sometimes, they are also better.

I have something to say about AvaTrade .I have traded with this broker for sometimes now. I've a big trading experience with various brokers and I'm really weatherbeaten. Now I'm trading here and completely satisfied with the parameters of trading and processing

Hey guys. Don't listen to anyone's complaints. I highly recommend it. AvaTrade provides great service and minimum deposit. This broker also has low commissions and interesting offers for the best CFD trading. Very popular broker, I invested and never regretted it.

The account verifying process is thorough in the details. There are no half measures. It has to be the standard; otherwise, no deal with Avatrade. It is unique. But I was having difficulty making a deposit. After making several attempts I received a call from AvaTradeand help me with my problem.

The team at AvaTrade has been on point from the jump! Support did a fantastic making sure my questions were answered and my needs were met in an extremely timely manner, very professional and helpful. I highly recommend!

Thanks to AvaTrade, I got the help and information and learn more interesting features. Be sure you will reach your goals with this website.

My account manager was very professional and an excellent communicator. Depositing funds onto my account was also simple and seemless, funds were available within minutes. Thank you all

The customer service is very polite and fast. The mobile phone application is a great tool to use. Avatrade has a lot of helpful information and materials on how to trade - they are awesome!

I would say it's one of the best brokers I have worked with so far. I started as a newbie. The customer account manager services are excellent. But in the future you can reduce the minimum deposit to below $100 - it would be great.

I have been looking for tested and trusted brokers to partner with not until I found AVATRADE. I really appreciate your quality services. Online chat and phone call support is also good. A mobile phone application easy to use on a mobile phone.

Great customer service. AvaTrade is a good company with good support and management. Everything is excellent ... I would recommend this broker

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?